Supercharged

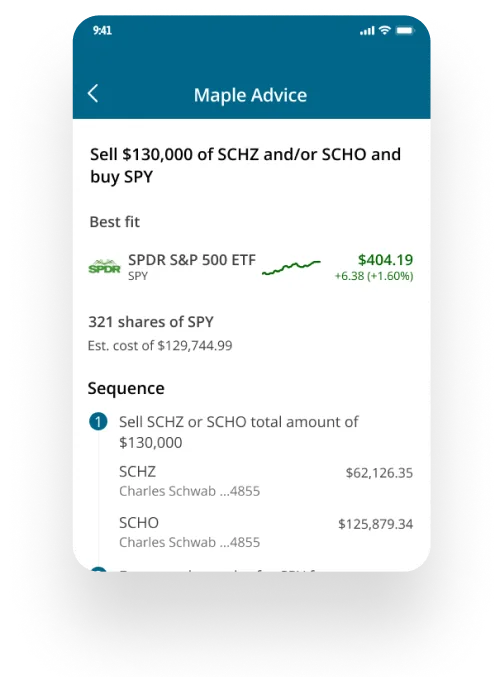

Personal Advice

Powerful insights and recommendations tailored to you. Advice that isn’t personalized is just noise. Maple is working 24/7, analyzing thousands of data points to delivers timely, relevant advices that fit your goals

Explore every angle and leave no stone unturned. Our analysis tools provide the breakdowns and visualizations you need. Understand your exposure and risk from every angle and optimize your financial life

This is how empowerment feels...

AI Wealth

Management

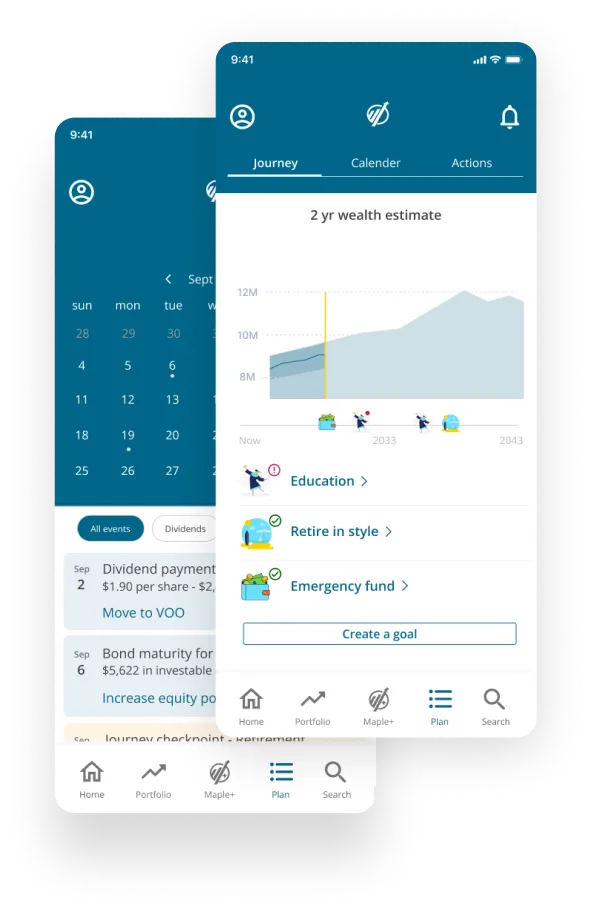

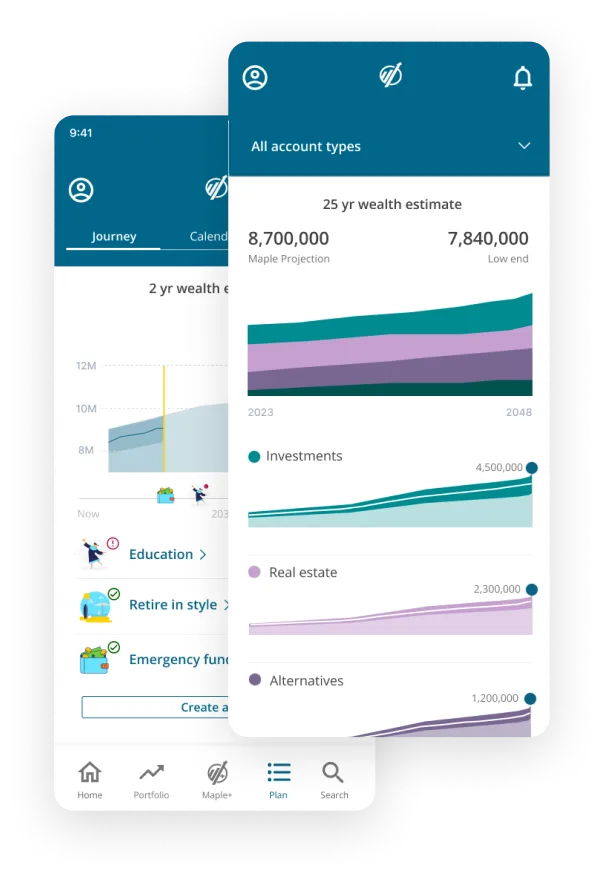

Know where you are going and how to get there. Our integrated planning platform helps you find your path, keeps track of what matters and delivers the guidance to get you there.

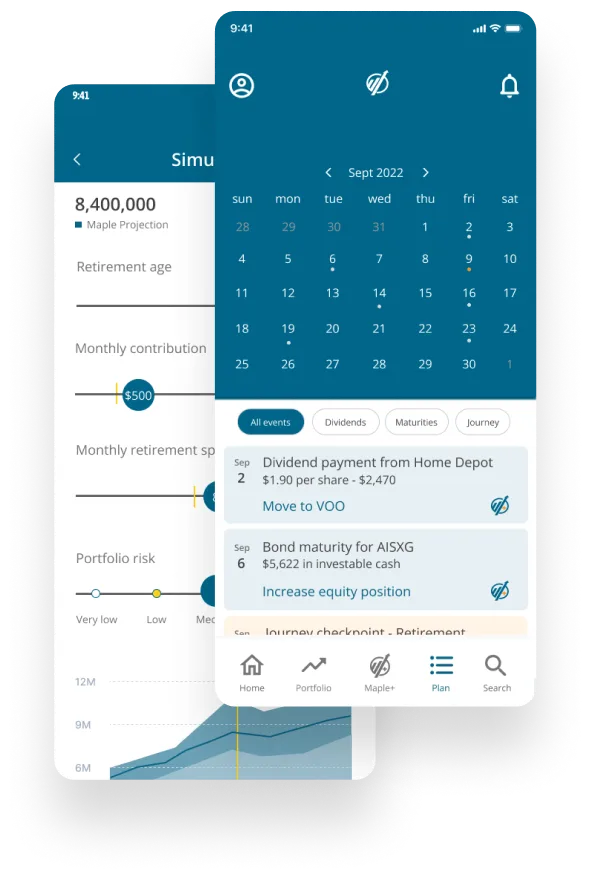

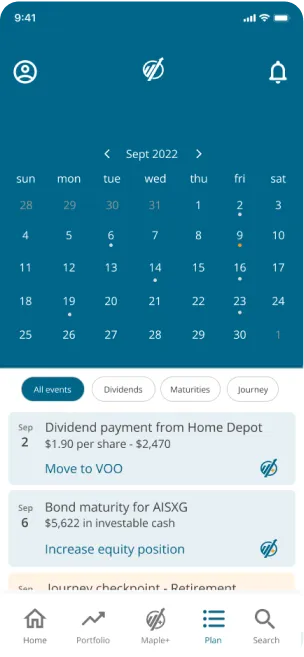

Everything that matters…all in one place Our calendar tracks the events for your holdings and your journey with enough lead time for you to make the right call.

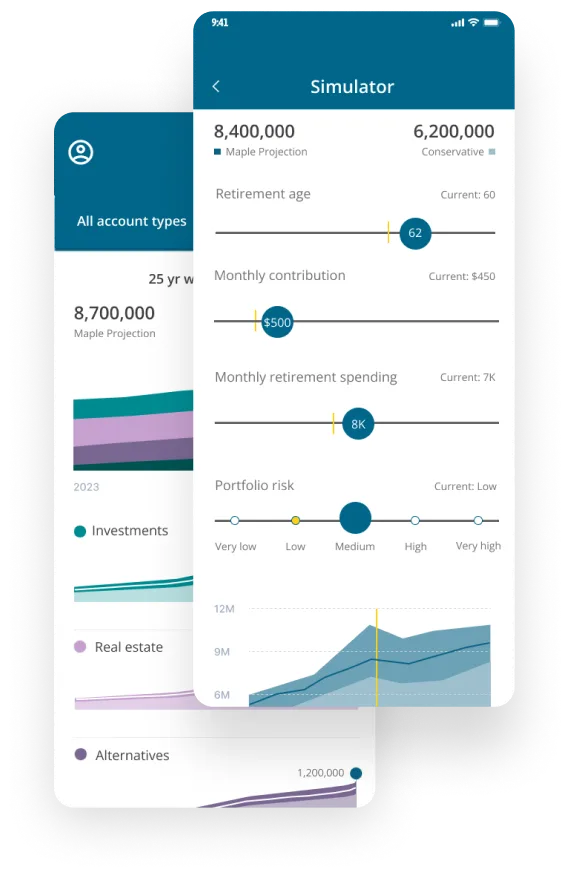

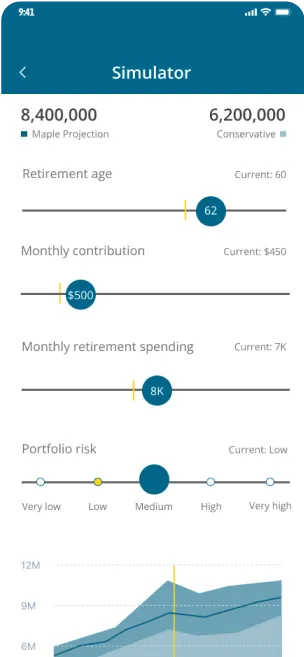

Ask ‘What if’ and know the answer. Experiment with different approaches to find the pathway that unlocks your potential. Our simulator allows you to see how adjustments in risk tolerance, investment mix and strategy can impact your wealth

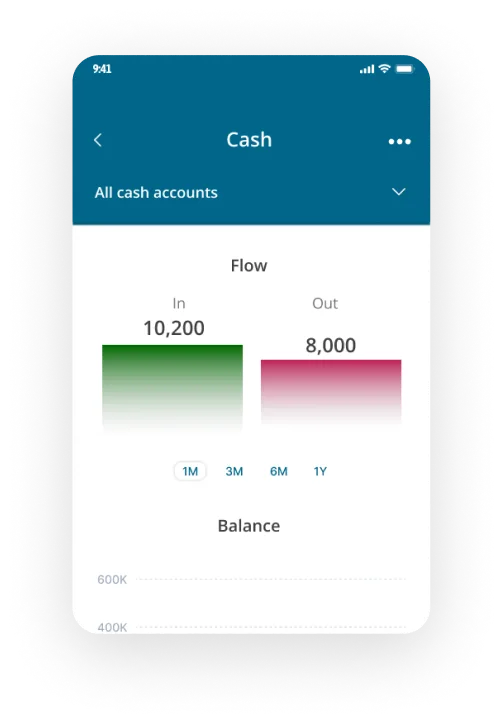

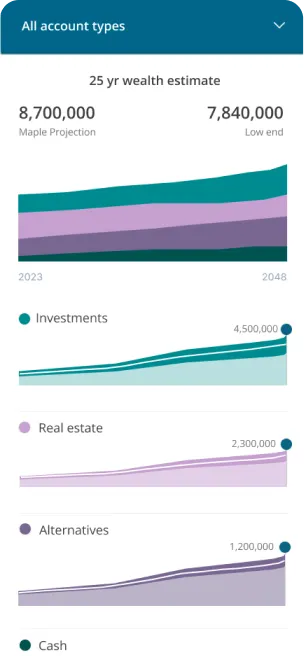

Bring your financial future into focus. Maple combines everything we know about you including cash flow, probable returns, income events and more to deliver a realistic projection of your wealth over time

Always Working

For You

m.Profiler

m.Tutor

Personal finance can be challenging. Our integrated mentor helps you master the concepts you need to reach your goals. We provide direct guidance so you will understand what is driving our recommendations

Be smarter with your money

More Features

Fees can represent a significant portion of your expenses over time and our tracking tools help keep you informed on what you are paying and alternatives that can save you money while achieving your goals

There is a lot to digest. Maple Discover organizes the chaos and delivers relevant and timely information from a variety of leading sources. Instantly know what matters for your holdings and broader trends that are impacting your future

We work with

We connect with over 12,000 institutions

FACTSET

PLAID

ZILLOW

FAQ

There is an unlimited amount of accounts you can connect to MAPLE. We enable aggregators to provide connectivity to thousands of institutions. MAPLE encourages you to connect all of your accounts, so our algorithms will be most effective in providing meaningful personalized insights and recommendations.

MAPLE X-Ray feature is a service MAPLE provides for you to get a deep understanding of your current financial situation. You shall think of it as a holistic financial checkpoint that shows you your overall wealth snapshot. It provides insights about what it means? Is it good or bad? Is it in alignment to my goals? How am I compared to the reference group? It also provides clues about the capability of MAPLE to optimize your situation. MAPLE aims to provide your first X-Ray just after initial registration and connection of your accounts. The more data you add during the registration process, the more meaningful X-ray outcome will be. The report is saved for you and you can run the test as many times as you want. Once a year (at the end of the year) MAPLE runs it anyway and presents to you a playback of your performance over the year starting with the X-ray of the previous year and getting to the current up to date one.

Yes. MAPLE includes a prediction module. We think that understanding the options of your future wealth is very important. Although no one can really say what will be the future, there are many ways to predict it under specific assumptions. The assumptions are coming from historical performance of the market and plan of future actions we can control. Our prediction module uses monte carlo calculation to simulate different extreme scenarios with their probabilities. MAPLE predict is a powerful engine that takes into account all of future cash flow events as well as portfolio mix, its risk level and market historical performance. The outcome is a timeline view of wealth and cash flow which gives you a view into the future…

Yes. MAPLE provides a powerful simulator for retirement. It allows you to control every aspect of the retirement and shows you immediately the impact of the change you wanted to test (retiring earlier, saving more annually, increasing the risk of the retirement saving accounts etc’). The fact that MAPLE is connected to all of your accounts and knows you, enables us to use your real data in the simulation and not assume things which are not even close to who you are. If you simulate something which is not realistic (either based on market conditions or your own personal situation) MAPLE will highlight it with the explanation of what we think is not realistic. If you are not sure how to simulate scenarios by modifying specific fields, MAPLE supports “question driven simulations”. You can ask: Can I retire at the age of 57? Or What shall I do to retire at the age of 57? Or When can I retire with a monthly income of $5K? etc’

Yes. MAPLE allows the user to add an asset manually. It is very simple and intuitive. MAPLE will ask you for the minimum required information to add the specific asset. There will be optional fields that can be added any time that will enable our AI engines to provide meaningful insights and recommendations.

No. MAPLE is a fiduciary financial service with a mission to empower you so you can manage your finances the best way possible. We will charge a fixed monthly fee for the service – it’s as simple as that. During the Beta period you can enjoy MAPLE for free